Gold Financial Perspective - March 2009

Gold Financial Perspective - November 2009>

Gold Financial Perspective - August 2009>

Gold Financial Perspective - May 2009>

H.S. Perlin Co., Inc.

Gold Financial Perspective

Volume 5 Issue 2 - March 2009

This newsletter is designed to provide timely and beneficial financial information. Current economic factors affect your personal financial decisions as well as your decisions for gold ownership today. We hope you find the enclosed information helpful and informative.

What's New with H.S. Perlin Co., Inc?

2009 brings a milestone to celebrate and some new and exciting additions

H.S. Perlin Co., Inc. is celebrating our 40th year in La Jolla! We are sharing this celebration with you by giving out some tasty treats. Don't forget to pick up some of our "gold" coin chocolates at your next appointment.

With this landmark we are also introducing our updated website. The new www.goldendures.com features a comprehensive introduction to our company and services, as well as current and historical data about gold. The "Gold Investing" section now includes various highly recommended articles, including "Basic Information About Physical Gold" and "15 Reasons Why You Should Own Gold Today."

In addition, the site now incorporates new pages such as "Gold in the News," (found in the "Data and Resources" section) which includes links to the latest information about gold and "Press and Media," which includes articles and videos about Joel D. Perlin and H.S. Perlin Co., Inc. This page, which can be accessed via a link in the top right corner of the site, highlights a recent video interview with Joel by San Diego's Daily Transcript, about gold and the current financial crisis.

We hope the new features will help keep you informed about what is happening in the world of gold and will help guide you in making decisions that affect your financial future. Please visit www.goldendures.com to explore all of the new additions.

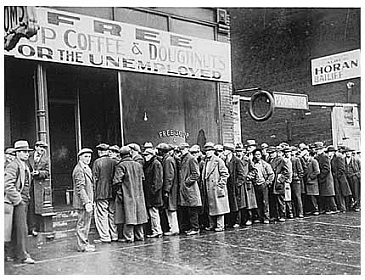

American Debt Trends Mirror Great Depression

Will historical household debt trends foreshadow a painful future for our economy?

For the first time since 1929, U.S. household debt has reached shocking levels, soaring to equal the nation's gross domestic product. Initiated by the housing boom and fueled by a surge in mortgage borrowing, 2005 revealed that families had collectively accumulated up to $11.5 trillion of debt at the fastest rate since 1985. As a result, household debt increased to pre-depression heights, reaching 100 percent of the GDP in 2007.

"We've been living very high on the hog. Our living standard has been rising dramatically in the last 25 years. And we have been borrowing much of the money to make that prosperity happen," writes Laura Conway of National Public Radio (NPR).

In comparison, household savings as a percentage of the GDP declined to 0.7 percent. This is a drastic drop in contrast to 1998 figures, when net savings equaled 6.5% of the GDP and to 1946 through 1985, when average net savings equaled 9.3% of the GDP.

The resulting unprecedented personal debt has left us with the harsh reality that this prosperity cannot last. "The entire world has been living above its means," economist and author Douglas Casey says, "You get wealthy by saving, and you get poor by spending more than you produce."

Though the economic downturn is illustrating the results of rampant spending, we have yet to witness the full effects of this nationwide irresponsibility. If the economy continues to follow the course that it took in 1929, the worst may have yet to come. However, in reaction to our precarious standing and with the fear of an uncertain future, people are once again returning to a commitment to saving. This is an imperative step toward rebuilding an economy, which is based on sound and strong financial fundamentals; these same fundamentals are necessary components of gold ownership.

Gold Around the World: China

China steps to the forefront of the gold world, becoming the top producer and approaching the top consumer

In a speedy and unprecedented move, China recently took the top spot as the world's highest gold producer. The change shocked the gold mining world, as South Africa had held the title, uninterrupted since 1905. Though gold mining began in the country in the Song Dynasty, China recently implemented a drastic increase in production. It boosted output by 12 percent between 2006 and 2007 alone, pushing the country into number one.

A South African decrease by 50 percent also affected the change, spurred by rising production costs, mining depletion and stricter safety regulations. In tandem with this downward shift, China's gold production increased monumentally. Production rose by 70 percent in the past ten years, prompted and encouraged by foreign and domestic investors and discoveries of untapped mines.

In recent years, China has increased output by up to 15 percent annually despite an overall decline in global gold production. Rapid capital expansion and the lower cost of labor have allowed the nation to continue growth while other producing countries have struggled with lower production.

In recent years, China has increased output by up to 15 percent annually despite an overall decline in global gold production. Rapid capital expansion and the lower cost of labor have allowed the nation to continue growth while other producing countries have struggled with lower production.

Production is not the only aspect of gold for which China has become noteworthy. Chinese companies and citizens annually consume nearly all of the gold that the country produces, which has led it to become the world's second largest gold consumer. The World Gold Council reported that China's gold demand tripled in 2008 and is expected to increase in 2009, possibly leading the country to surpass second

place and move into number one.

India, which currently holds the top position, has experienced a rapid decline in demand since the price of gold rose substantially early this year. The country has consistently held the title due to its citizens' strong religious and ceremonial ties to gold, but high prices along with the global economic downturn have kept many people from buying, even during the peak marriage season.

If present trends continue, China will greatly surpass India in the near future, leading the emerging nation to become a force to be reckoned with in control over the earth's limited supply of gold.

The New Gold Rush

The economic downturn has turned investing into a rush for safety

Though the past year has shown the sales of homes, automobiles and other consumer goods plummeting, there is one thing that the recession hasn't slowed down: gold. Around the world, private citizens, companies and governments have rapidly increased their gold holdings. In February, the World Gold Council reported that the demand for gold increased by 64 percent from 2007 to 2008.

How can we explain this sudden rush on gold?

Gold has always served as a store of value. It has historically been used as a currency and is easily transferred into various contemporary currencies, thereby giving it universal value. Gold provides a level of privacy that other investments lack and further maintains its appeal through its limited availability. In times of crisis, gold becomes even more valuable because it retains value as paper money loses its worth.

While the recognized worth of gold has not grown, panic about the U.S. economy and the U.S. dollar has. The trend began with the near-collapse and subsequent sale of Merrill Lynch, when even previous skeptics initiated a turn to gold.

Not only is fear of financial meltdown driving investors toward the metal, but fear of hyperinflation is also fueling the rush. New investors are recognizing that gold provides a form of insurance against the weakening results of printing currency. As H.S. Perlin Co., Inc.'s President, Joel D. Perlin states, "Our government's short term fixes will translate into long term inflation and further ex post facto devaluation or actual financial devaluation of the US dollar. As a result, gold will continue to appreciate and grow for the decade to come."

Perlin has responded to this rush with a plea for patience. Since the year's start he has advised his clients to remain calm and to not get caught up in the fear of rising prices, particularly as gold surpassed $1,000 in late February. Perlin has successfully advised clients in times like these, and emphasizes that buying in the current market requires "patience, strategy and long term commitment. We believe that this should be seriously undertaken over the next twelve to eighteen months."

Regardless of timeliness, owning gold remains at the top of many investors' priority lists. Economist Michael Pento may express this sentiment best: "The government can print endless money, but they cannot increase the supply of gold [and] anything the government cannot replicate by decree, I want to own."

USA Patriot Act Provisions

USA Patriot Act Provisions