Gold Financial Perspective - August 2009

Gold Financial Perspective - November 2009>

<Gold Financial Perspective - May 2009

<Gold Financial Perspective - March 2009

<Gold Financial Perspective - January 2009

H.S. Perlin Co., Inc.

Gold Financial Perspective

Volume 5 Issue 4 - August 2009

This newsletter is designed to provide timely and beneficial financial information. Current economic factors affect your personal financial decisions as well as your decisions for gold ownership today. We hope you find the enclosed information helpful and informative.

ONE EXPERT'S OPINION...

An Emerging Cycle into Tangible Wealth

By Joel Perlin

What asset class is attracting serious money in hard times? Gold of course. This new shift to tangible assets also includes high-quality, rare coins and collectible coins, including rare gold coins.

2009 continues to be a year of economic hardship and uncertainty for many. Even so, many hundreds of millions of dollars have already been spent this year to acquire rare and certified gold coins as well as rare coins in non-precious metals. The significance of these events during an economic downturn magnifies the importance for alternative investment strategies when serious losses have occurred in the stock market, bond market, and real estate world.

Why are people buying rare gold coins and non-precious metal rare coins at this time, when less informed investors are hoarding their money? Astute investors see the present and long-term opportunity for the following reasons:

- Strong demand with limited supply.

- Internationally accepted certification of authenticity.

- Desirability to place in permanent trust for children and grandchildren.

- An expanding international trading marketplace throughout the world.

I have just returned from the American Numismatic Association's International Money Show, the premiere "world series" of numismatic events. Dealers, investors, traders and collectors from throughout the world gathered to buy and sell. Of key importance, there were more than two dozen six figure single coin sales.

After nearly a half a century of both observation and participation, it is apparent to me we are witnessing the strongest market move for diversification, demonstrated by the magnitude of wealth being transferred into hard assets since the late 1980s.

I am convinced we are seeing an emerging cycle into tangible wealth. It is this expert's opinion that this is the time to participate in what will continue as a growth industry and long-term investment strategy over the next decade.

European Central Banks Agree to Limit Gold Sales

The central banks of Europe secure their own reserves with a five-year limitation of gold sales

On August 7th of this year, the European Central Bank and 18 other central banks around Europe announced a new, five-year agreement to limit their gold sales. The new agreement, which will be implemented on September 27,2009, significantly reduces the annual cap of gold sales from their previous agreement of 500 to 400 metric tons per year.

On August 7th of this year, the European Central Bank and 18 other central banks around Europe announced a new, five-year agreement to limit their gold sales. The new agreement, which will be implemented on September 27,2009, significantly reduces the annual cap of gold sales from their previous agreement of 500 to 400 metric tons per year.

The change is being viewed by experts as a positive move for the gold market. UBS AG analyst, John Reade, told Bloomberg that the agreement "removes the small chance that European central banks would have dumped gold onto the market in an unconstrained manner." This added protection, however, does not apply to the International Monetary Fund, which has yet to agree to any limitations.

Without the IMF on board, the possibility remains that China, Russia or another central bank could buy up the 403 tons of gold it has proposed to sell from its 3,217 tons in reserve. Both China and Russia, the world's sixth and tenth largest gold holders, respectively, are looking to increase their current reserves.

The IMF's plan for gold sales has yet to be approved by its board, and the new central bank agreement will likely sway their decision about if and how they may liquidate this portion of their holdings. Europe's central banks addressed the situation by stating, "The signatories recognize the intention of the IMF to sell 403 tons of gold and noted that such sales can be accommodated within the [agreed upon] ceilings."

The Swiss National Bank, the world's seventh largest gold holder, signed the limiting agreement and even went so far as to say they had no plans "for any further gold sales in the foreseeable future." Because the precious metal is such an integral part of their monetary reserves, they reported that it better serves the country if it remains where it is.

Though the central banks' agreement was formulated in order to regulate and stabilize the gold market, Fairfax analyst, John Meyer predicted that the agreement "combined with currency volatility [and] ongoing uncertainty [...] should help gold prices to go higher." This is good news for governmental and individual gold holders worldwide, and has spurred prospective investors to act before this shift begins.

Gold Around the World: Vietnam

When the Vietnamese sought refuge in the U.S. after the war, they brought more than we had anticipated

From the country's earliest establishment in 938 AD until the conflicts leading to the onset of the infamous Vietnam War, Vietnam had longtime evaded the attention of many Westerners. With its agriculturally centralized economy based on the cultivation of the wet rice crop, it is not surprising that Western onlookers did not view the nation as a major player in the world's ever growing industrial economy.

During the 1960s and early 1970s the world's focus shifted toward Vietnam not only for its physical conflict, but for an entirely unexpected reason: its relationship with gold. This was brought to Western attention as Vietnamese refugees began to filter out of the country and into the United States and various European nations. An article from Washington's Daily Record from July of 1975 outlined how refugees in transitional camps around the United States were selling their gold in order to assist with the start of their new lives here. The predominance of these transactions took place at San Diego's very own, Camp Pendleton.

During the 1960s and early 1970s the world's focus shifted toward Vietnam not only for its physical conflict, but for an entirely unexpected reason: its relationship with gold. This was brought to Western attention as Vietnamese refugees began to filter out of the country and into the United States and various European nations. An article from Washington's Daily Record from July of 1975 outlined how refugees in transitional camps around the United States were selling their gold in order to assist with the start of their new lives here. The predominance of these transactions took place at San Diego's very own, Camp Pendleton.

Many of the Vietnamese citizens who could afford to leave the country were wealthy businessmen and their families. In the necessary haste to escape the turmoil, they needed to bring their wealth in a form that was easily transportable and inherently valuable to the society they were entering. Gold was the easiest and best option for the job. Those who were unable to bring money or valuables sold their gold wedding bands upon arrival. While in these entry camps, Vietnamese refugees sold over $40,000 worth of gold each day, at a time when the precious metal was trading at a mere $161 per ounce.

Some refugees held onto large stores of gold after arrival, the Daily Record article stated: "Now that they're in the United States, holding onto the gold and knowing they can get money for it any time makes the refugees feel a little more secure." This source of financial and emotional security transcends both culture and generation, and continues to provide protection and relief for contemporary gold investors worldwide.

Today, the Vietnamese relationship with gold remains notable for their heightened respect for the precious metal's value over Vietnam's currency, the Dong. Transferring all savings into gold is a popular practice for the people, in order to safeguard their hard earnings from the probability of inflation. Additionally, gold is widely used throughout the nation for large transactions, such as the purchase of real estate. Because of this, many Vietnamese must take out loans to acquire the gold they need to purchase a home. These procedures reflect not only the citizens' distrust of the Dong, but also their recognition that paper currency does not hold its value.

Today, the Vietnamese relationship with gold remains notable for their heightened respect for the precious metal's value over Vietnam's currency, the Dong. Transferring all savings into gold is a popular practice for the people, in order to safeguard their hard earnings from the probability of inflation. Additionally, gold is widely used throughout the nation for large transactions, such as the purchase of real estate. Because of this, many Vietnamese must take out loans to acquire the gold they need to purchase a home. These procedures reflect not only the citizens' distrust of the Dong, but also their recognition that paper currency does not hold its value.

Like those who left the country over a quarter century ago, the Vietnamese who remain there today can see what some Americans are only now beginning to recognize: The value of gold reaches beyond any one nation, culture, or society. Unlike paper currency, with its capacity for unlimited printing, gold is a limited resource with limited supply. This quality, along with its beauty and longevity, makes gold a universally recognized source of ever-growing value.

Gold as Currency: Part 2 - A Contemporary View

The Twentieth Century has witnessed the worldwide shift from the gold standard to fiat currencies, resulting in the continuous devaluation of paper and electronic money

During the latter part of the Nineteenth Century, a major shift in the use of currency was taking place. A great need arose for coins of smaller denominations to ease the difficulty of everyday transactions. As more valuable metals, such as gold, were not suited for this purpose, Western nations began to issue paper money and "token coins," made of silver, copper and mixed metals. At this time, these forms of currency were backed by a standard for gold exchange.

At the start of the Twentieth Century, the international gold standard kept inflation at bay and provided a foundation for the steady rise of economic prosperity. Though it did face problems with the speed of mining output and the fear of mine exhaustion, the system offered a unification that spanned culture and currency. With this background, the gold standard gave citizens of the world confidence that the stability of a nation's currency would not affect the value of their money. This newfound trust and openness allowed for the unprecedented flow of international direct investment capital, which helped to develop the United States, Canada, Australia and various other emerging markets of the time.

At the start of the Twentieth Century, the international gold standard kept inflation at bay and provided a foundation for the steady rise of economic prosperity. Though it did face problems with the speed of mining output and the fear of mine exhaustion, the system offered a unification that spanned culture and currency. With this background, the gold standard gave citizens of the world confidence that the stability of a nation's currency would not affect the value of their money. This newfound trust and openness allowed for the unprecedented flow of international direct investment capital, which helped to develop the United States, Canada, Australia and various other emerging markets of the time.

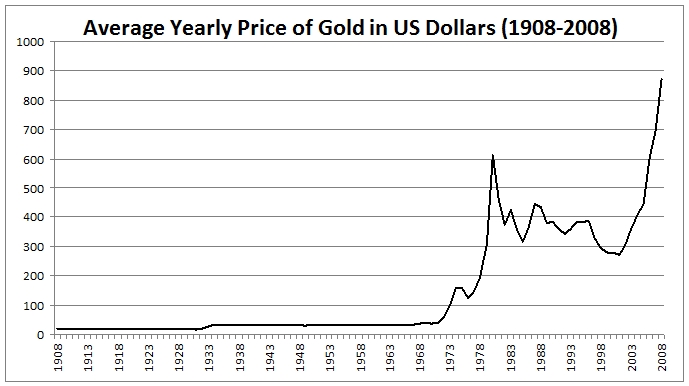

With the onset of World War I in 1914, the system encountered a major shock as European countries using the gold standard found that they could not afford the costs of the war. To allow for the necessary printing of currency, some nations began to abandon the system. At this time, many countries began to stop issuing gold coins as currency.

The need for war funding not only caused a widespread shift to fiat money (paper money, not backed by gold), but also created a background with which the new money would begin to inflate. David Hackett Fischer, Professor of History and Economic History at Brandeis University, cites war expenses as the main cause of post-war inflation: "In World War I, the American people were characteristically unwilling to finance the total war effort out of increased taxes. [Thus,] much of the expenditures in World War I, were financed out of the inflationary increases in the money supply."

As the war came to a close, those countries that had left the gold standard made various attempts to reinstate it. Because of the mismanagement of currency during the war, however, these attempts proved unsuccessful.

In 1933, in an attempt to combat post-war inflation and the economic effects of the Depression, President Roosevelt signed Executive Order 6102, "forbidding the hoarding of Gold Coin, Gold Bullion, and Gold Certificates," by U.S. citizens. The act required Americans to give up all but $100 worth of their gold coins, gold bullion and gold certificates to the Federal Reserve. In exchange for these items, citizens received $20.67 per troy ounce. Exempt from the ruling were rare-gold coin collectors, artists, jewelers, dentists and others who customarily used gold for professional purposes.

In 1933, in an attempt to combat post-war inflation and the economic effects of the Depression, President Roosevelt signed Executive Order 6102, "forbidding the hoarding of Gold Coin, Gold Bullion, and Gold Certificates," by U.S. citizens. The act required Americans to give up all but $100 worth of their gold coins, gold bullion and gold certificates to the Federal Reserve. In exchange for these items, citizens received $20.67 per troy ounce. Exempt from the ruling were rare-gold coin collectors, artists, jewelers, dentists and others who customarily used gold for professional purposes.

In 1934, just one year after the U.S. government's seizure of gold, the government increased the price of gold by 70 percent, to $35 per troy ounce, an inflationary move that was deemed necessary to pull the world out of extreme depression. A decade later, in 1944, the Bretton Woods international monetary system defined the value of all nations' currencies in relationship to the U.S. Dollar. In turn, the value of the U.S. Dollar was defined by its relationship to gold. The Bretton Woods system helped form one of the most successful periods of economic history. The achievements of the gold standard from the early Twentieth Century, were only somewhat recaptured again. The Bretton Woods system resulted in short term growth, progress and depressed inflation.

Over time, the $35 per troy ounce ratio became unrealistic as the dollar had slowly inflated and as the war in Vietnam spurred a sudden swell in the demand for gold. In 1968, a two-tier system replaced the defined ratio, whereby the gold that was used to settle international accounts remained at $35 per troy ounce and the price of gold on the private market was free to fluctuate based on supply and demand.

By the early 1970s, the costs of the Vietnam War led to increased domestic spending, inflation and debt. On August 15, 1971, President Nixon implemented a 90-day wage and price freeze, a ten percent surcharge on all imports, and a permanent closure of the "gold window." Just as Roosevelt ended the U.S. citizen's ability to exchange the U.S. Dollar for gold, Nixon's act did the same for foreign governments. Nixon and his advisors moved forward with the ruling without consulting members of the international monetary system; the act was thus dubbed by the international community: the Nixon Shock.

Through his act, Nixon ended the government's practice of repaying international debts with the precious metal. The new ruling resulted in a swift devaluation of the U.S. Dollar, which fell by 7.9 percent in 1971 alone. The gold price was officially increased to $38 per troy ounce in May of 1972 and again in September of 1973 to $42.22 per troy ounce. Along with this second increase, the two-tier gold pricing system was terminated. At the end of December 1974, U.S. citizens were again allowed to privately own gold and the price of the precious metal reached the unprecedented level of $195 per troy ounce. Following this height, in 1975 the U.S. treasury rejoined the gold trade and sold $1.25 million ounces within the year.

In the nearly forty years since the Nixon Shock, the U.S. Dollar has experienced consistent inflation; what $1.00 could buy in 1971 now costs $5.32. During this period, we have witnessed history repeat itself in various fashions in regard to gold. Like WWI and WWII, the modern wars in Iraq and Afghanistan have challenged our currency with increased spending, increased printing of money and increased debt.

Since July of 2008, the United States National Debt Clock has demonstrated the increase of our nation's debt from $9.5 trillion to its current height of nearly $11.7 trillion. This rapid increase has even spurred a project to create a new National Debt Clock with more place holders to accommodate the increasing debt to come. This illustrates not only the affects of our currency crisis, but also the unchecked capacity for all governments of the world to mass produce paper money (and electronic money) as they please, without regard to their countries' economic welfares.

This fact paired with an awareness of the historical relationship between gold and currency, has lead people all around the world to trade their paper money for the precious metal. While worldwide currencies cannot hold value, citizens are taking control of their wealth by holding a uniquely valuable, constant and lasting asset. Like our predecessors have done for centuries, people are continuing to turn to gold.

USA Patriot Act Provisions

USA Patriot Act Provisions